The empirical evidence does not confirm the hypothesis that the public debt tends to be more stable in countries where the (real) interest rate is systematically lower than (real) growth. On the contrary

Download the Policy Brief

From the Policy Brief:

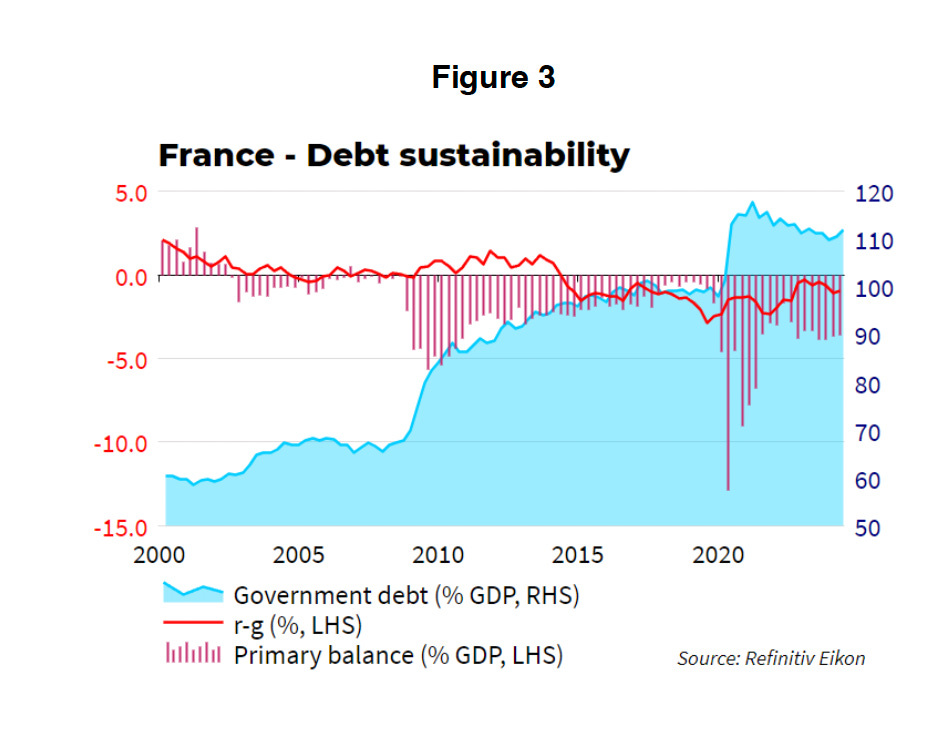

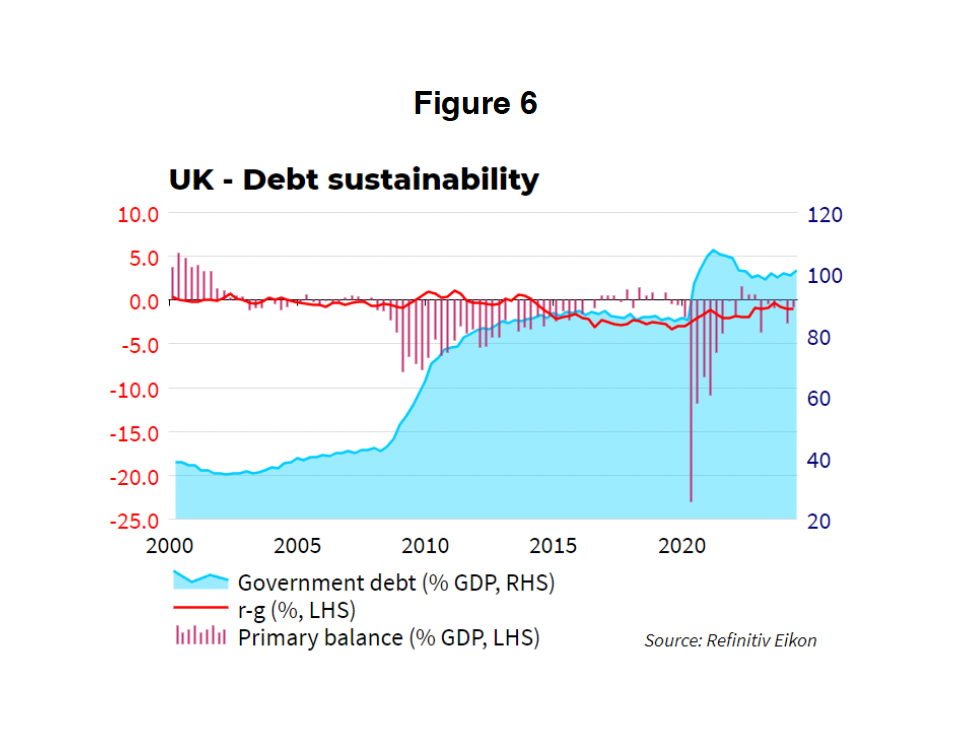

Figures 1-6 show that in countries where the interest rate was lower than nominal growth, the debt often increased markedly over the past quarter century (as a percentage of GDP).

The most obvious case is the US, where the debt-to-GDP ratio doubled, from 60% to 120% of GDP, despite a negative r-g for most of the period. In Japan and in France, debt increased irrespective of the r-g level.

Only in Germany the correlation between r-g and the debt dynamics turned out as expected, as debt decreased in parallel with lower interest rates. In Italy, the relationship changed over time.

Overall, r-g does not look like a good predictor of debt development.

The data suggests that the public debt depends much more on the “forgotten” variable of the debt sustainability equation, i.e. the primary surplus. The debt increased systematically in countries like the US, Japan, or France, despite the favorable r-g conditions, because of the large and apparently incompressible primary deficits.

In fact, over the past quarter of a century, these three countries never recorded a primary surplus.

Focusing primarily on the r-g relationship means implicitly that the third key variable of the debt sustainability analysis, i.e. the primary balance, is assumed to be exogenous.

This is a standard hypothesis for policy variables. Evidence suggests however that this is not only simplistic but also misleading.

In fact, the three variables that determine debt sustainability are closely interrelated and even interdependent.

The IEP@BU Mission

Founded by Bocconi University and Institute Javotte Bocconi, the Institute for European Policymaking @ Bocconi University combines the analytic rigor of a research institute, the policy impact of a think tank, and the facts-based effort of raising public opinion’s awareness about Europe through outreach activities. The Institute, fully interdisciplinary, intends to address the multi-fold obstacles that usually stand between the design of appropriate policies and their adoption, with particular attention to consensus building and effective enforcement.

The Institute’s mission is to conduct, debate and disseminate high-quality research on the major policy issues facing Europe, and the EU in particular, its Member States and its citizens, in a rapidly changing world.

It is independent from any business or political influence.

The IEP@BU Management Council

Catherine De Vries, Dean for International Affairs and Professor of Political Science at Bocconi University

Daniel Gros, IEP@BU Director

Sylvie Goulard, IEP@BU vice-President, Professor of Practice in Global affairs at SDA Bocconi School of Management

Silvia Colombo, IEP@BU Deputy Director

Carlo Altomonte, Associate Professor at Bocconi University and Associate Dean for Stakeholder Engagement Programs at SDA Bocconi School of Management

Valentina Bosetti, professor of Environmental and Climate Change Economics at Bocconi University

Elena Carletti, Dean for Research and Professor of Finance at Bocconi University

Eleanor Spaventa, Professor of European Union Law at Bocconi Law School

Share this post